WSFS Bank Study Finds Americans Confident Managing Their Money, but Many Factors Impact Financial Security

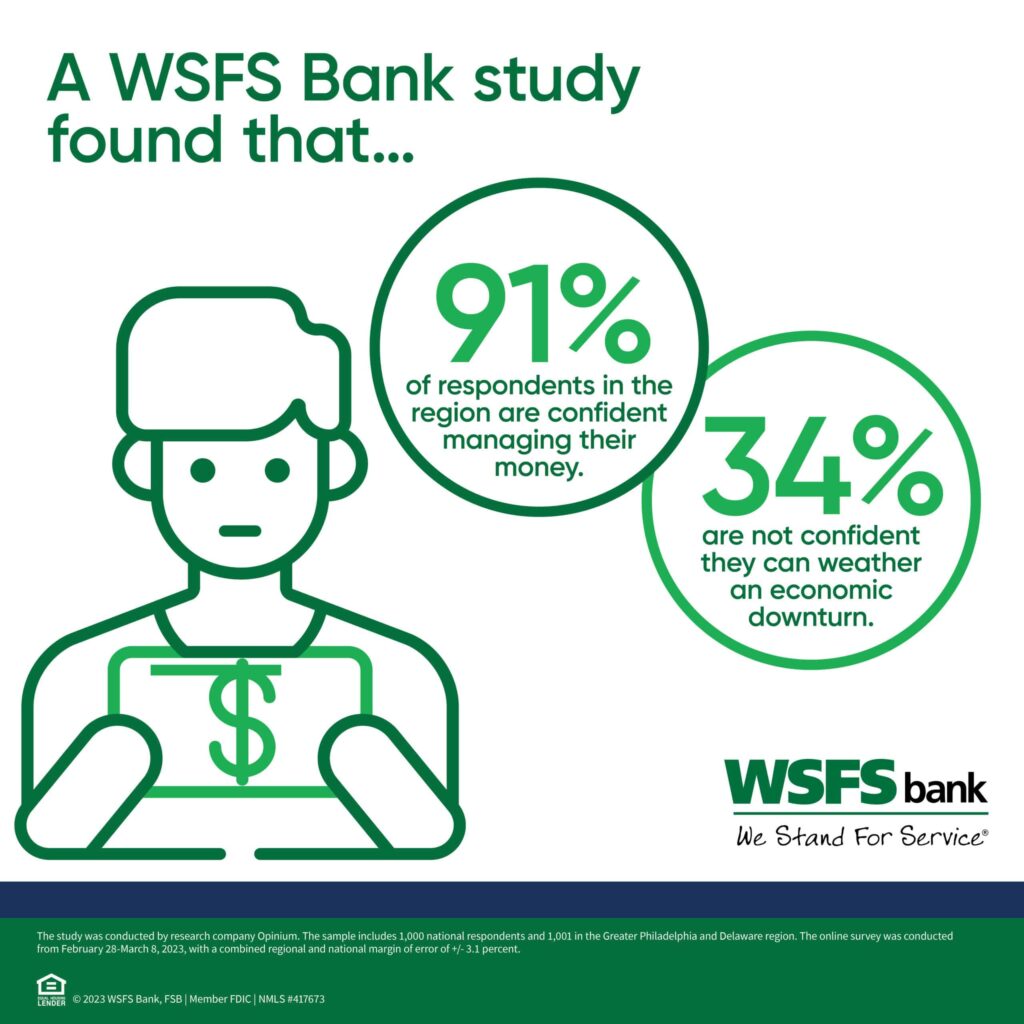

A new survey from WSFS Bank found Americans are confident managing their money, including 91 percent of respondents in the Greater Philadelphia and Delaware region (89 percent nationally), but 34 percent in the region were not confident they could weather an economic downturn or recession (41 percent nationally).

The study, which surveyed 1,001 residents of the Greater Philadelphia and Delaware region and 1,000 national respondents, gauged the financial goals, confidence, and access of those 18 years and older.

Impact of Inflation and Rising Costs

The study found 34 percent of regional respondents (39 percent nationally) were not confident they could afford rising costs of living, and many are making changes to their spending habits as a result.

Nearly two-thirds (61 percent) of total regional respondents said they are cutting back on non-essential spending, compared to 69 percent nationally, while 42 percent of regional respondents said they are delaying a large purchase like a home, car, or furniture. Thirty-eight percent of regional respondents are focusing more on paying down debt because of rising costs, while 33 percent are tapping into their savings to help pay for everyday items.

Rising costs and interest rates have also resulted in 25 percent of regional respondents saying they have more debt now than a year ago. Among regional respondents, Black (71 percent) and White (74 percent) respondents were more likely to cite higher prices and cost of living due to inflation as a reason for their increased debt than Hispanic or Latino (57 percent) respondents.

Half (52 percent) of regional residents said if faced with an emergency expense of $1,000 or more, they would have to borrow money, take out a loan, or pay it off with a credit card over time. Sixty-one percent of regional Hispanic or Latino respondents would need to do this, compared to 50 percent of White and 46 percent of Black respondents.

“Inflation and rising costs have had an impact on many consumers’ financial security and goals over the past year,” said Shari Kruzinski, Executive Vice President and Chief Consumer Banking Officer at WSFS Bank. “High interest rates are making borrowing more expensive. One silver lining to increased rates is the opportunity to earn more on your savings by using higher-interest savings tools like High Yield Money Markets and Certificates of Deposit (CDs). The most important thing is to strive to maintain a balanced budget. If you need more assistance, consider setting up an appointment with your local banker to discuss the accounts, products, and services that may work best for your unique financial situation.”

Financial Education and Confidence

The impact of the current economic environment also played a role in the top financial goals this year, with regional respondents saying that building an emergency fund (52 percent) is their top goal, followed by increasing savings in retirement accounts (49 percent) and paying off debts (47 percent).

A key driver behind respondents’ financial confidence was their financial education. Banks and financial service providers (43 percent) topped the list of where regional respondents received their financial education, followed by websites, blogs, social media, podcasts, and other online sources (42 percent).

Regionally, 44 percent feel they did not receive enough financial education and guidance about managing their money, and this figure rises to 52 percent nationally. Black respondents in the region (55 percent) were more likely to agree with this sentiment than White (45 percent) and Hispanic or Latino (30 percent) respondents. On the regional level, 45 percent of respondents said they felt disadvantaged by the amount of financial education they received, with Hispanic or Latino respondents (60 percent) being more likely to agree than White (39 percent) and Black (44 percent) respondents.

“Financial education plays a key role in building the confidence needed to achieve many major goals in life,” said Vernita Dorsey, Senior Vice President, Director of Community Strategy at WSFS Bank. “We understand the importance of working with the broader community to provide key lessons to students and adults of all age ranges. Learning is lifelong, and I encourage consumers to use tools like the WSFS Knowledge Center for tips and resources, in addition to our in-person, Associate-led workshops to further build their financial confidence.”

Importance of Financial Access and Advice

Seventy-one percent of regional respondents said they wished they had received more financial education (64 percent nationally), which can play a key role in building financial confidence to access the products and services needed.

Regionally, 30 percent said their financial institution has shared helpful financial advice through emails, online, or through an app, and 26 percent said they were offered in-person advice.

Sixty-two percent in the region said they found it easy to access financial products to meet their individual needs, with Hispanic respondents most likely to agree (68 percent), followed by White (64 percent) and Black (47 percent) respondents.

High interest rates (39 percent) and fees/costs (39 percent) are the leading barriers to entry for regional residents when it comes to using financial products, with 36 percent and 43 percent of national respondents agreeing, respectively.

Learn more about WSFS Bank.

Connect With Your Community

Subscribe for stories that matter!

"*" indicates required fields