Homebuying in 2024: Are Discount Points Worth the Cost?

When compared to previous years, 2023 mortgage rates skyrocketed, making homebuying difficult or even out of reach for some. In an attempt to alleviate this challenge, many homebuyers turned to discount points, which essentially means they paid extra money upfront to lower their interest rate. Think of it like a VIP pass to a lower monthly payment. Sounds good, right?

Well, maybe not. While more people purchased points in 2023, especially when refinancing, it wasn’t a guaranteed win for everyone. Every situation is different, and there are other factors at play that should be considered.

The Breakeven Point

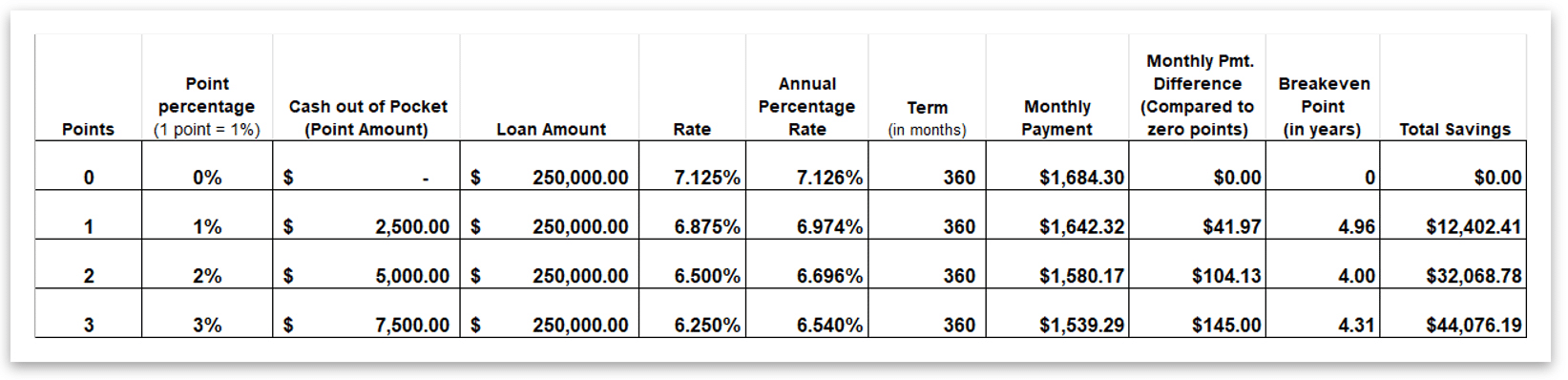

Consider the example below. You can see that purchasing points work in your favor with a lower monthly payment and total savings over the life of the loan. However, it’s important to consider the breakeven point, which is the amount of time it takes to save money in monthly payments when compared to a loan without points. Each point costs 1 percent of the loan amount as part of the closing costs and usually reduces the rate by .25 percent. It can sometimes reduce it by more, reducing the breakeven point. Ideally, you hope to reach that breakeven point quickly to begin your net savings.

Many economists predict rates will start or continue to fall in the coming year. If rates fall below the interest rate you bought down to and you decide to refinance at the lower rate, then purchasing your points might not have been in your best interest. In the example below, the breakeven point for the points purchased is around four years.

Mortgage Experts Can Help

When it comes to weighing the pros and cons of paying for points, it’s not as cut-and-dry as it seems. Even after reaching the breakeven point, you need to consider the cost of the points in addition to the normal closing costs and down payment. With over 400 ways to configure a mortgage, there’s no one-size-fits-all answer when it comes to buying a house (or saving money!), so the best thing to do is talk to a mortgage expert. They can advise you about whether it’s in your best interest to pay for mortgage points or if you’re better off taking the rate at face value. Local mortgage experts will ask you the right questions to find a loan framework tailored to your unique situation and goals.

Learn more about C&N Bank and its various banking solutions, including checking accounts, savings accounts, mortgages, business loans, and more.

__________________

Stacey Sickler is the Director of Residential Mortgage Lending at C&N. Sickler has been in Mortgage Lending for 25 years including 21 with C&N. She is responsible for the mortgage lending line of business and does a limited amount of originating. Her office is in the Sayre Branch, located at 1827 Elmira Street, Sayre.

Connect With Your Community

Subscribe for stories that matter!

"*" indicates required fields