New Hope-based Orchestra BioMed Closes $110M Private Stock Sale, Plans to Go Public Through SPAC Deal

After closing a $110 million private stock sale, New Hope-based Orchestra BioMed plans to go public by teaming up with Health Sciences Acquisition Corp. 2, a special purpose acquisition company, writes John George for the Philadelphia Business Journal.

The business combination agreement is set to provide the combined company with a minimum of $70 million. This new entity will be known as Orchestra BioMed Holdings.

The combined company is expected to have a $407 million fully diluted pro forma market cap as well as an enterprise value of $158 million. David Hochman, the chairman, CEO, and co-founder of Orchestra BioMed, will lead the company.

Orchestra BioMed’s $110 million Series D financing is not contingent on the completion of the business combination with the SPAC. Investors who took part in the financing round included Medtronic and Perceptive Advisors, among others.

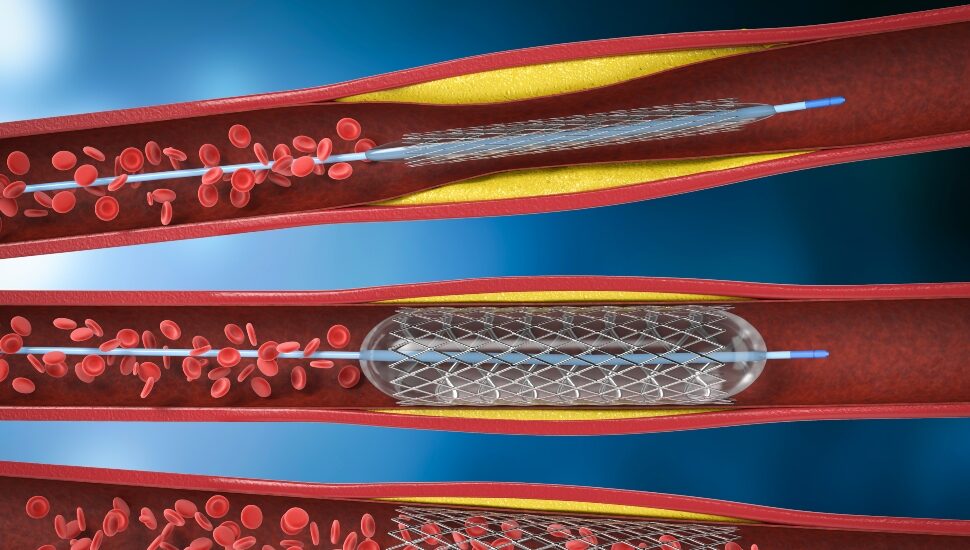

Orchestra BioMed also announced it has entered into a collaboration with Medtronic to develop a potential high blood pressure treatment for patients who are indicated for a cardiac pacemaker.

According to Hochman, the three connected deals “further validate the potential of Orchestra BioMed’s flagship development programs” for advanced cardiac pacing therapies.

Read more about Orchestra BioMed in the Philadelphia Business Journal.

Connect With Your Community

Subscribe for stories that matter!

"*" indicates required fields