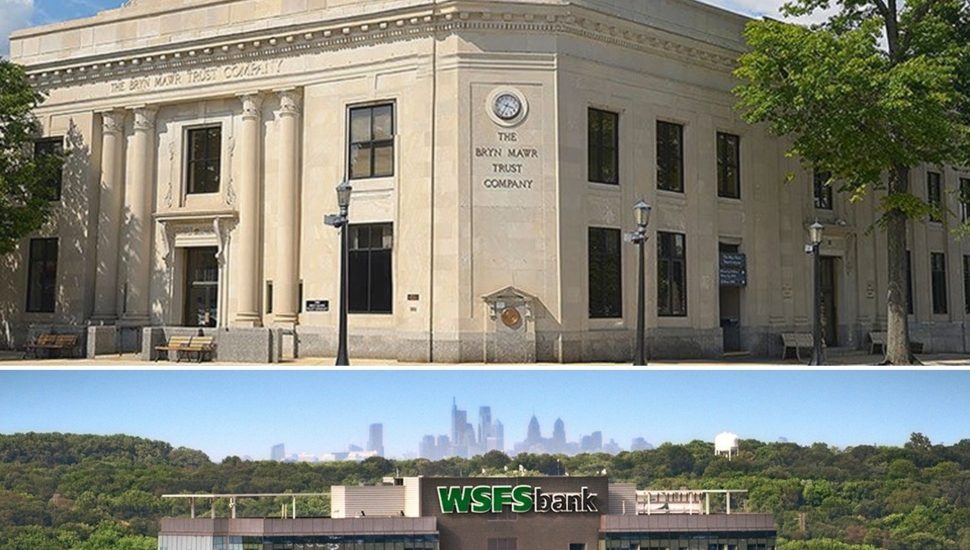

Bryn Mawr Trust to Merge with WSFS Bank, Solidify Its Preeminent Position in the Region

Bryn Mawr Trust has announced it will merge with WSFS Bank in a transaction valued at approximately $976.4 million.

The combination of two of the high-performing, locally based financial services companies solidifies their preeminent position in the Greater Philadelphia region. With nearly $20 billion in assets and an approximately $43 billion Wealth Management business as of Dec. 31, 2020, WSFS believes that following the merger it will be the only bank in the region with distinct market-share advantages, including market knowledge, local decision-making, a full-service product suite, and a balance sheet to compete with larger regional and national banks.

Under the terms of the agreement, stockholders of Bryn Mawr will receive 0.90 of a share of WSFS common stock for each share of Bryn Mawr common stock. The per-share value equates to an implied value of $48.55 for Bryn Mawr stockholders based on the closing price of WSFS stock on March 9, 2021.

“This combination aligns with our strategic plan,” said WSFS President Rodger Levenson. “Combining with Bryn Mawr allows us to accelerate our long-term strategic objectives, including scale to continue to invest in our delivery and talent transformations. This combination also creates the premier wealth management and trust business in the region and the sixth-largest bank-affiliated wealth management and trust business nationwide under $100 billion in assets. Together, we are poised and positioned to continue to serve and outperform for all our constituents and to deliver sustainable high performance for years to come.”

“We strongly believe in the value creation by combining with WSFS and enhancing the strengths of our institutions,” said Bryn Mawr President Frank Leto. “This is a sound decision for Bryn Mawr, our stockholders, our clients, and the communities we serve. We are combining with WSFS because it is an established institution with deep roots in the region and the utmost focus on doing the right thing for our clients.”

The merger agreement has been approved by the boards of directors of both companies. Closing of the transaction is subject to customary approvals by regulators and stockholders of both companies. Pending those approvals, the transaction is expected to close early in the fourth quarter of 2021.

Connect With Your Community

Subscribe for stories that matter!

"*" indicates required fields