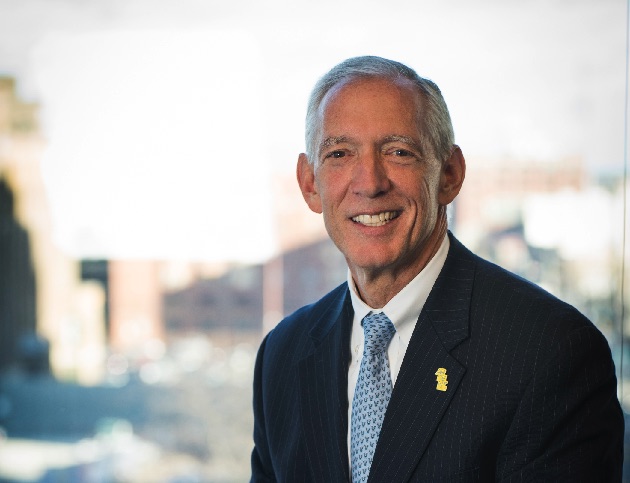

Montgomery County Leadership: Rob Werner, CEO, Ardent Credit Union

Rob Werner, CEO, Ardent Credit Union, spoke with MONTCO Today about growing up in Bryn Mawr, summers spent in Stone Harbor, his first job picking up trash on the beach, his journey into financial services, and what brought him to SB1, a small, relatively unknown Philadelphia-based credit union.

Rob Werner, CEO, Ardent Credit Union, spoke with MONTCO Today about growing up in Bryn Mawr, summers spent in Stone Harbor, his first job picking up trash on the beach, his journey into financial services, and what brought him to SB1, a small, relatively unknown Philadelphia-based credit union.

In the conversation, Werner shares the process for how SB1 transformed into Ardent, how the company developed its ubiquitous, “Grit-based” marketing campaign, and how he hopes Ardent’s new Oaks branch will become a community gathering space where people come to learn about how to handle their money, build their credit scores, and buy a house.

Where did you grow up, Rob?

I was born the third of four children at Lankenau Hospital in Wynnewood and grew up on Darby Road in Bryn Mawr right on the line between Montgomery and Delaware Counties. My mom was a homemaker and my dad was a commercial banker who worked for several different banks in the Philadelphia area. His dad, my grandfather, was also a Philadelphia banker who worked his way up from teller to CEO of Western Savings Bank while attending Wharton at night.

What memories do you have of growing up in Bryn Mawr?

Our family experience was traditional for the day. Typically, all six of us would be together for both breakfast and dinner every day. Our house was at the edge of the 133-acre Fox Field Farm which eventually was developed about the time I started college so while growing up it was our playground. Most days after school when we were younger the four of us were outside playing on the farm until dinnertime. Since we were not in a development there weren’t a lot of other kids around, so the four of us were all our best friends, a tradition that carries on to this day.

And while most of my childhood memories centered around the house and playing on the farm, I have a very clear memory of the day I came home from school and there was a color television in our family room, a gift from my grandparents. While the color TV didn’t help the Three Stooges, I remember being blown away the first time watching cartoons and the Wonderful World of Disney in color.

Where did you spend your summers?

My grandparents had a place in Stone Harbor so when school was out every year my parents loaded us into the car, and we spent the entire summer at the shore. My parents would rent a house for half the season and the other half we would spend at our grandparents house. As soon as I turned 14, I started working summer jobs at the shore. The house stayed in the family for 50 years and was the place we all still gathered even as adults with our kids until it was sold. Looking back, I didn’t appreciate how lucky I was to be able to spend all summer at the beach.

What was your first job?

My first job at 14 was cutting the grass on all the grass islands that lined 2nd Avenue in Stone Harbor and Avalon and at 15 I got a summer job cleaning the beach at Stone Harbor. I worked with a couple of other kids, and we would walk up and down the beach all day picking up trash with pitchforks. I wasn’t paid all that much, but it was enough pay for mini golf or buy ice cream, candy or anything else I needed while I was at the beach.

The summer after I turned 16 I got a job at the Golden Inn on the line between Avalon and Stone Harbor. I did a little of everything including parking cars, checking people into the hotel, maintenance, and even lifeguarded for a day. I worked wherever I was needed.

What lessons did you learn from those jobs at the shore that stay with you today?

The job at the Golden Inn, where I stayed until I graduated college, taught me a lot about working with the public, working for tips, and working together with a fun staff at the Inn. You meet all different types of people working at a hotel and you learn early on if you do a good job selling and talking to the visitors, the tips will be better. I think everybody at some point should have to work for tips or work with the public to appreciate the jobs these people have to do.

Did you play any sports in high school?

I attended a Catholic parochial grade school and other than playing basketball, kickball or dodgeball at recess, the school didn’t have any organized sports. For high school, I went to Friends Central (FCS) on City Line Avenue, where my father, aunt and brother had gone, and played soccer and tennis.

How did a Catholic kid do at a Quaker high school?

Friends Central was a very different environment than the two parochial schools I attended from first to eighth grade. Many have heard stories from friends or experienced for themselves life being taught by nuns. A very structured and ridged approach and all those stories are all true! Friends Central was very different where the student and opinions were valued and the more questions you ask, the better.

Was Friends Central a good fit for you?

Yes, at times I think the education I received at Friends Central was more important than the formal education I got in college because FSC taught me how to think and question.

What kind of music were you listening to back then?

I loved almost all music but listened mostly to the rock bands of the time including Bruce Springsteen, Allman Brothers, Elton John, Edgar Winter Group, ELO, Toto, Duran Duran and Genesis to name just a few. While I was pretty young, my parents did get us together to see the Beatles perform on the Ed Sullivan show so maybe that is where my love of rock and roll began. I remember when I bought Elton John’s Goodbye Yellow Brick Road album with money I earned my dad thought it was a big waste of money.

Where did you go to college, Rob?

My parents focus was on making their kids complete people. There was never any overdo pressure to do well in school, just work hard and do your best. When it was time to apply to colleges, there was an expectation to consider Lafayette College in Easton where my other grandfather had attended and was a College All-American for football.

My dad and brother also attended Lafayette. And while I did apply to Lafayette, a buddy and I talked about going to the University of Miami so I applied to Miami, Villanova and Lafayette.

While I was accepted at all three, my parents were not excited about me going to Miami and Lafayette did not have any dorm rooms available so I decided to go to Villanova and pursue a BA degree in Economics.

Why Liberal Arts and Economics?

There were already three generations of bankers in my family, including my brother and there was no way I was going to be a banker also. I considered getting a law degree and because environmental issues were hot back then, use my law degree to protect the environment. But a funny thing happened on the way to considering a legal profession, I got a job at a bank consulting firm during my senior year at ‘Nova. So after taking the law boards and talking to my parents about attending law school, the beginning of earning real money became attractive fast.

During the second half of my senior year at Villanova, Don Littlewood, a friend of my dads, ran into me working one night at the St. Davids Inn, now the Radnor Hotel, and invited me to come work for his bank consulting firm. After I had graduated in the spring, I took a whole weekend off and started my career in financial services back working at the consulting firm.

What did Don Littlewood see in you, Rob?

Growing up, I always had a job and was always working earning my own money. Don knew I was getting an Economics degree and I was doing both some night audit and front desk work at the hotel so I think he was just looking for someone who could crunch some numbers at his growing consulting firm.

Who gave you your big break, Rob?

Great question and I think I have been the recipient of many opportunities in my life and different paths that lead me to the CEO role at Ardent. The decision to go to Villanova began the journey because of the opportunity that Don Littlewood afforded me as a college senior. Had I not gone to Villanova, I might not have gotten the job working at the consulting firm, and had I not been working where I was, I would not have met my wife.

Shortly after I started working at the firm, the partners brought on a new marketing director named Judith Quinlan. Judith had a big corner office, and I had the little cubical outside her office. We shared much of the same background, upbringing and family values. We became friends early on, then started dating and eventually got engaged then married. We just celebrated our 29th wedding anniversary and have 3 children and 2 grandchildren.

What took you into banking?

One of the firm’s clients was a bank in Upper Bucks County and they were looking for a CFO. John Shain, one of the partners in Littlewood, Shain and Company was a firm believer in allowing people to do their own thing, take chances and not be afraid of failure. The culture at the consulting firm was to just figure a way to get the job done and allowed us to all work both independently and collaboratively achieving goals. So while I had only taken two accounting classes in college, I had six years working in the ‘don’t be afraid of taking chances’ and do whatever it takes kind of environment that John Shane and Don Littlewood had created. I told management at the bank that I didn’t have much accounting experience but that didn’t seem to matter much and they invited me to join them and help them grow the bank. I was 28 at the time.

You must have been a bit shocked to be 28 years old and be a bank CFO?

I guess I saw it as an opportunity and a chance to build something. I was the youngest on the senior management team by at least 10 years but never really thought about that until you just ask the question. I’ve only had four jobs in my career including my current job at Ardent, and I absolutely loved every one.

What brought you to Ardent?

I was working for a community bank in Monmouth County, N.J., as Chief Operating Officer. Great job, but the office was 93 miles from my house in Phoenixville. The daily commute plus the fact most all the bank’s employees were Giants, Jets, Yankees, Mets and Ranger fans made the job challenging at times! While home over the 2012 Christmas break, I called a recruiter I knew and let her know I was interested in exploring job opportunities closer to home and that she should call me if she heard of anything. She said she had the perfect opportunity for me, but I had to act quickly because the credit union, SB1, was nearing the end of their CEO interviewing process.

[uam_ad id=”54865″]

Even though I have been in the Philadelphia region my entire life, I had never heard of Sb1 Federal Credit Union. I did some research and discovered a strong financial company with a great history of serving its members, primarily from the pharma industry. In talking to insiders in the credit union industry, I found out the company had a good reputation and a good board of directors so I decided to pursue the opportunity. I joined SB1 as the President/CEO in June of 2013.

This new Ardent we see out there has all happened on your watch?

Yes and while the company had a strong reputation, it wasn’t growing as fast as its peers. It was pretty clear that I wasn’t the only one who had not heard about Sb1 FCU so with the help of the board and a relatively new senior management team, we put a strategy together to put Ardent on the map and begin to grow the organization.

As part of the rebranding efforts we thought it was important to discover who we really are as an organization. We hired an outside firm to take us through the process and talk to SB1 staff trying to get to the bottom of our organizations personality. At the end of the assessment, the marketing firm told us SB1 was built on a passion to help our members and a “do whatever it takes” kind of philosophy. They said we had grit and suggested our tagline should be ‘Grit makes great’.

As part of the rebranding efforts we thought it was important to discover who we really are as an organization. We hired an outside firm to take us through the process and talk to SB1 staff trying to get to the bottom of our organizations personality. At the end of the assessment, the marketing firm told us SB1 was built on a passion to help our members and a “do whatever it takes” kind of philosophy. They said we had grit and suggested our tagline should be ‘Grit makes great’.

Talk about powerful and it all made sense. Our people were all about taking care of our customers and doing whatever it takes to get the job done. Philadelphia is a city with grit being passionate about our sports teams and with a hard-working mentality. The message resonated with my team and I and we knew it would resonate with our Delaware Valley customer base as well.

Has the money spent over the last year getting that “Grit” message out there been a good investment?

Absolutely. I have had so many people tell me they have either seen the wrapped Septa busses, the billboards, the radio spots on Pandora, I know the messaging is getting out. The Credit Union has also won multiple awards around the branding as well as the new branch design that we recently opened in Oaks and we continue to win National service awards around how we take care of our members. At the same time we changed our branding, we also changed the charter of the organization to now being open to anyone who lives, works, attends school or church in Philadelphia and the surrounding four counties.

How large is Ardent Credit Union, Rob?

We’re at $650 million in assets and the twelfth largest credit union in Pennsylvania but when we think about size it is the number of members we are serving and loans we have granted to our members. We just recently crossed the 32,000 members and with the new branch in Oaks looking to continue that growth.

When I first started in 2013, I showed the team a picture of the Philadelphia skyline with a superimposed SB1 logo on top of one buildings. I wanted to give our people a visual of what SB1 (Ardent) could become someday. We are on our way.

What are the challenges and opportunities you’re focused on for the balance of 2017?

One of the challenges I shared with my executive team is how do we make sure we keep our family-owned, small business feel which is clearly reflective to our members. See as a Credit Union, we are a member-owner financial cooperative. We exist to serve our members and as we grow, we want to make sure we don’t lose that family-like connectiveness with our members and staff.

Now that we are a community chartered we see a great need for financial education and wellness. With the opening of the Oaks branch earlier this year, the plan is to host a lot of financial wellness seminar and other fun topics for the community. We want to be a gathering place for the community. The more people we teach about how to handle their money, build their credit scores and buy a house, the stronger our community will be.

Personally, I turn 60 this year and I’ve challenged myself to run a marathon before the end of the year! I’ve run a couple of half-marathons and changed my mindset to reevaluate how I can train for the physical and mental aspects of running a full marathon. Not sure yet but that is a question that I will have an answer to shortly.

Finally, Rob, what’s the best piece of advice you ever received?

Through their actions, my parents conveyed a message of the importance of family and friends. My mother unfortunately passed away way too young and about a year after I graduated from college and that experience taught me life is truly too short and you need to find a way to enjoy every day you are given.

Professionally, I think it was that understanding and underpinning that Don Littlewood and John Shain gave me to work hard and not worry about failing. Chase your passion and see where it takes you.

Connect With Your Community

Subscribe for stories that matter!

"*" indicates required fields