Pennsylvania Among Top Ten States With Lowest Credit Card Debt

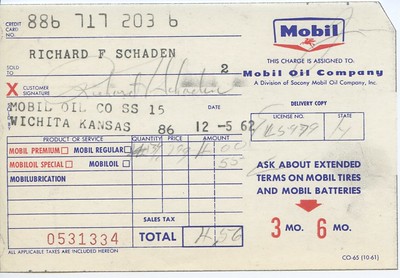

Image via Shawn at Creative Commons.

Pennsylvania is among the top ten states with the lowest credit card debt in the nation, according to a new report by WalletHub.

Americans began 2021 owing nearly $900 billion in credit card debt.

This is a bit lower than last year, thanks in part due to record paydowns. Some of that debt reduction came by way of Americans using their stimulus checks to improve their financial standings during the lockdowns.

However, the analysis projects that net credit card owings will increase once again in 2021 by $60 billion.

Pennsylvania, bucking the trend, has remained among the top ten states with the lowest card debt at No. 46. This places it in the sixth spot, behind only South Dakota, Mississippi, Alabama, Hawaii, and New York.

It also signifies something of an upturn in plastic use; last year, Commonwealth residents ranked fifth in this same evaluation.

The Keystone State has a median noncash consumer debt of $1,871 with a cost of interest until payoff of $134. Its expected payoff timeframe in Pennsylvania is 10 months and 12 days.

Read more about local credit card debt at WalletHub.

Connect With Your Community

Subscribe for stories that matter!

"*" indicates required fields